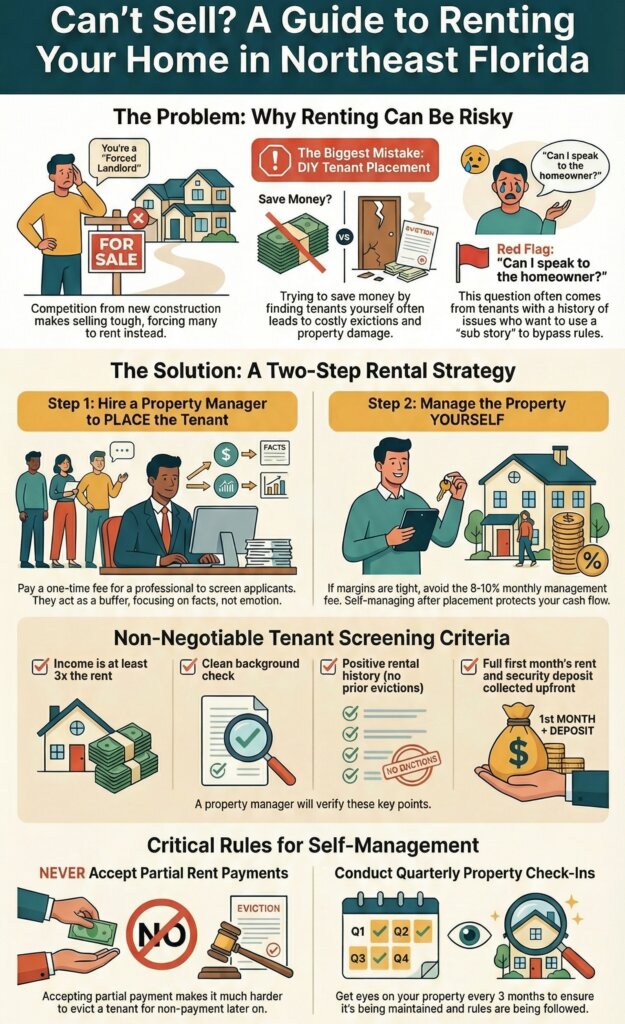

5 Hard Truths for Northeast Florida’s “Forced Landlords”

Watch this first:

Welcome to the Club Nobody Wanted to Join

If you bought a house in Northeast Florida — Jacksonville, Orange Park, Clay County, Duval County, or Nassau County — in the last few years, you may be stuck.

You want to sell.

The market says not right now.

You’re competing with brand new construction. Builders are buying down rates, paying closing costs, and offering incentives you cannot match. When buyers compare your home to a new one at a similar price, they usually choose new.

That leaves a lot of homeowners with one option they never planned on: renting the house instead of selling it.

This is what I call forced landlording. Renting isn’t a strategy you chose. It’s something you’re doing to avoid taking a big loss.

If that’s you, there are some hard truths you need to hear before you get burned.

1. Your Kindness Will Cost You Money

The biggest mistake forced landlords make is trying to be nice.

You listen to sob stories.

You bend your rules.

You try to help someone out.

I’ve watched this play out over and over again, and it almost always ends the same way:

- Late rent

- Partial payments

- Property damage

- Court

- Eviction

- Thousands of dollars gone

Nice does not pay the mortgage.

In a market with razor-thin margins, emotion is expensive. Discipline is what protects you.

2. The Most Dangerous Question a Renter Can As

If a prospective tenant asks,

“Can I speak directly to the homeowner?”

pay attention.

That question often precedes a story designed to get you to bend the rules.

Undisclosed pets.

Extra adults living in the home.

Poor rental history.

Inability to pay full deposits.

Once you’re emotionally involved, your judgment slips. That’s where problems start.

This is why having a professional screener matters. They don’t get pulled into stories — they focus on facts.3. Full-Service Property Management Can Be a Financial Trap

For homeowners who bought recently, the margins on rentals are extremely tight.

Here’s a real-world scenario:

- Mortgage payment: $2,300

- Market rent: $2,400

- Property management fee (10%): $240

Now you’re losing money every month.

That’s not investing — that’s bleeding slowly.

On tight-margin rentals, you are:

- One missed payment away from trouble

- One broken AC away from losing the year

- One bad tenant away from months of damage and vacancy

You cannot afford unnecessary expenses.

4. Hire a Screener, Not a Full-Time Manager

If being nice costs you money and full management doesn’t pencil, here’s a disciplined solution:

Use a property manager only to place the tenant.

Do not use them for ongoing monthly management if margins are thin.

This hybrid approach saves money and gives you professional screening without the ongoing cost.

A property manager’s real value isn’t collecting rent — it’s protecting you from bad tenants.

They:

- Verify income (at least 3x the rent)

- Run background and credit checks

- Review rental history

- Collect full deposits upfront (first month + security)

If rent is $2,500, I want to see $5,000 before keys are handed over.

Once a qualified tenant is in place, you can manage the property yourself with structure and discipline.

5. Never, Ever Accept Partial Payments

This rule is absolute.

Do not take partial rent payments.

Partial payments complicate the eviction process and weaken your leverage. I’ve seen this single mistake cost homeowners months of rent and thousands in legal fees.

This isn’t cruelty. It’s business.

Full payment or legal action. No middle ground.

Discipline After Placement Still Matters

Even with a good tenant, you must stay proactive:

- Quarterly inspections with proper notice

- AC filter changes

- Visual checks for damage or leaks

- Documentation of every communication and payment

Small issues become big problems when ignored.

When Renting Still Doesn’t Make Sense

Sometimes, even with the right process, renting still isn’t the smartest option.

If the numbers don’t work and risk is too high, selling — even at a discount — may be the better move.

That’s where talking to a trusted cash buyer can help you understand your real options without pressure.

This Market Rewards Discipline — Not Kindness

If you’re a forced landlord in Northeast Florida, remember this:

Ignore the stories.

Enforce standards.

Protect your investment first.

If you want help deciding whether renting or selling makes the most sense for your situation, reach out. I’m happy to walk through the numbers with you and help you choose the smarter path.

You didn’t choose this market.

But you can choose how you respond to it.

Want more content like this?

Watch the full breakdown above.