A Practical Guide for the 2026 Market with a Real Jacksonville Example

Making One of Life’s Biggest Financial Decisions

If you are considering a move in Northeast Florida, you are likely facing one of the biggest financial questions most people ever make: is it better to rent or buy a home right now?

There is no universal answer. The right decision depends on your finances, your time horizon, and where the market is heading. The goal here is simple: replace uncertainty with clarity.

The Northeast Florida housing market is entering a transition phase heading into 2026. Interest rates are expected to ease, inventory is improving, and buyers are finally seeing more options. That shift makes this the right time to revisit the rent versus buy question with real data, not assumptions.

This guide breaks down:

- Current Jacksonville rent vs buy numbers

- The true cost of renting and owning

- Long-term financial trade-offs

- The 2026 outlook for Northeast Florida

- A real 2023-built Jacksonville home example

1. Is It Cheaper to Rent or Buy in Jacksonville Right Now?

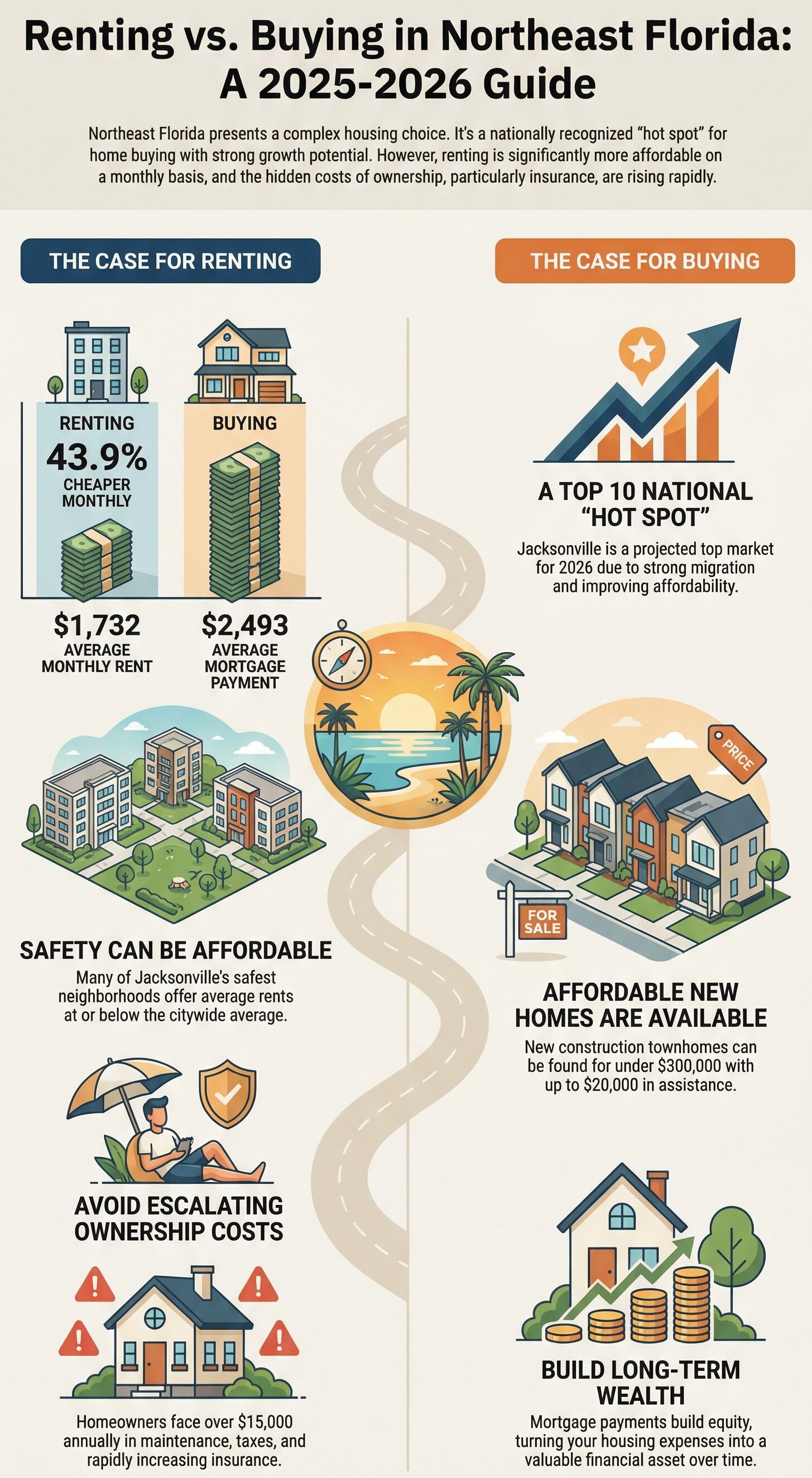

On a monthly basis, renting is still cheaper than buying in Jacksonville. A recent Bankrate study confirms that renting costs less than owning in all 50 major U.S. metro areas, including Jacksonville.

Jacksonville Monthly Cost Comparison

| Metric | Average Monthly Cost |

|---|---|

| Average Rent | $1,732 |

| Average Mortgage Payment | $2,493 |

| Buy-Rent Gap | 43.9 percent more to buy |

That 43.9 percent gap means the average mortgage payment is nearly 44 percent higher than the average rent payment. A major driver of this gap in Florida is insurance, which has risen sharply over the past several years.

On paper, renting looks cheaper. But monthly cost alone does not tell the full story.

2. The Full Cost Breakdown: Renting vs Owning

2.1 The Costs of Renting

Renting is predictable and simple, which is why it appeals to many people in uncertain markets.

Primary rental costs include:

- Monthly rent payment

- Security deposit

- Renters insurance

- Utilities

Renters are not responsible for maintenance or repairs, which removes risk and surprise expenses.

2.2 The Costs of Owning a Home

Homeownership comes with higher upfront and ongoing costs.

Upfront costs

- Down payment

- Closing costs

Ongoing monthly costs

- Mortgage principal and interest

- Property taxes

- Homeowners insurance

- Maintenance and repairs

Florida insurance deserves special attention. A university-backed study found the average Florida homeowners insurance premium exceeded $4,200 per year, more than double the national average. The same research showed rising insurance costs can also pressure home values, making insurance a strategic factor, not just a bill.

3. A Real Jacksonville Example: 928 Allison Street

To ground this discussion in reality, consider a 2023-built home at 928 Allison Street in Jacksonville.

Property Overview

- Built in 2023

- 4 bedrooms, 2 bathrooms

- 1,163 square feet

- Carport

- Fenced backyard

- Tile flooring throughout

- 2023 appliances included

- Hardy board siding

At a price of $225,000, estimated monthly ownership costs land around two thousand dollars, depending on loan type and assistance programs.

Comparable rentals in the same area range from $1,500 to $2,000, often on much older homes built in the 1990s or early 2000s.

This is where the decision becomes strategic rather than emotional.

4. Beyond the Monthly Payment: Long-Term Trade-Offs

Renting Long Term

- Flexibility to move

- Lower responsibility

- Lower upfront costs

- No equity accumulation

Buying Long Term

- Equity builds with each payment

- Long-term hedge against rent increases

- Stable housing payment with fixed-rate loans

- Wealth building over time

Redfin’s chief economist summarizes it clearly:

If you plan to stay in a home more than five years, buying usually becomes worthwhile because enough equity has been built.

This five-year benchmark is critical when evaluating rent versus buy.

5. The 2026 Outlook for Northeast Florida

According to the National Association of Realtors, 2026 is shaping up as a transition year.

Key Market Trends

- Mortgage rates are expected to ease toward 6 percent, improving affordability

- Inventory is increasing, giving buyers more choices

- Home prices are still rising, but at a slower and more sustainable pace

Jacksonville was specifically identified as a 2026 housing hot spot due to:

- Continued inbound migration

- Better affordability compared to national averages

- A higher share of listings priced within reach of local incomes

A reduction in rates from 7 percent to 6 percent could allow tens of thousands of additional Jacksonville households to qualify for homeownership.

This matters because it supports long-term demand, even if short-term buying feels expensive.

6. How to Decide What’s Right for You

Renting offers flexibility and short-term savings. Buying offers long-term stability and wealth building. In a market still projected to grow around 4 percent annually, ownership becomes more compelling for those planning to stay put.

Ask Yourself:

- Will I live in Northeast Florida for more than five years?

- Do I have funds for down payment and closing costs?

- Can my budget handle higher ownership costs, including insurance?

- Am I prepared for maintenance responsibilities?

- Do I value flexibility or long-term equity more right now?

There is no wrong answer. There is only the answer that fits your situation.

Final Thoughts

The Jacksonville market is no longer overheated, but it is still fundamentally strong. Renting may be cheaper today, but ownership can make sense sooner than many people expect, especially with newer homes priced below regional averages.

A 2023-built home like 928 Allison Street shows how close the rent versus buy math has become in Northeast Florida.

The smartest move is not guessing. It is running real numbers based on your timeline and goals.

If you want help doing that, reach out. Clarity always beats assumptions.