Real estate isn’t always the big payday you see on TV.

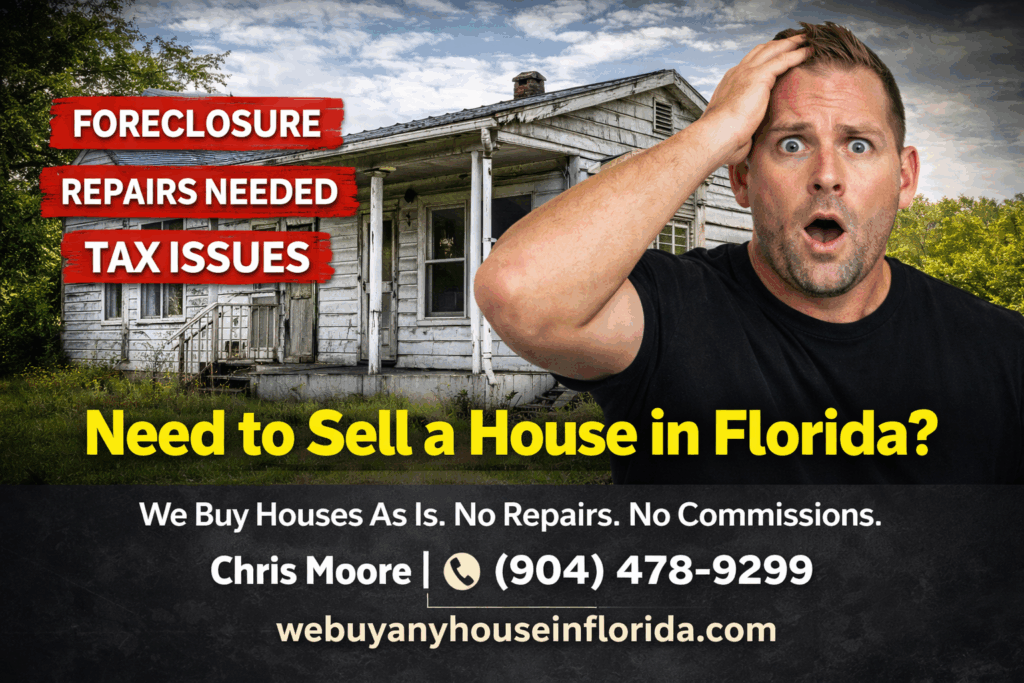

Most headlines highlight massive profits and instant equity increases, but anyone who has been in the industry long enough knows the reality: some deals outright fail, and some properties cost more after purchase than they were worth on paper. For homeowners facing tough situations — foreclosure, repair needs, tax issues, tenants who won’t leave — understanding why these deals go wrong is vital. It can save you from getting stuck or undervaluing your home, and it helps you recognize the right kind of buyer who can actually close.

The Market in 2026: A Reality Check for Sellers

To put today’s challenges in context, the housing market at the start of 2026 shows a mixed picture. Florida’s overall real estate activity has gained momentum in terms of closed sales, pending contracts, and new listings compared with last year, and inventory levels are expanding as sellers return to the market. Yet median prices have edged lower, buyers are cautious, and homes are taking longer to sell in many regions.

Across the U.S., home sales were at decades-low levels through 2025, with existing home sales hovering near the lowest pace since 1995. Mortgage rates — a major affordability driver — have come down to around 6% after years above 7%, but persistent price levels and economic strain still challenge many potential buyers.

Florida, in particular, has seen one of the highest foreclosure rates in the nation, as rising insurance premiums, taxes, and ownership costs squeeze financially stretched homeowners.

In this environment, traditional buyers are more selective than ever, and homes that have condition issues or access challenges — like those in the stories below — often struggle to move without a cash buyer who understands what they are walking into.

A Real Deal That Went Wrong: Middleburg Mobile Home

A few years ago, Katie and I pursued a mobile home in Middleburg that showed real promise at first glance. We found the homeowner through a pre-foreclosure lead service (REDX), and it took persistent follow-up to build enough rapport for her to finally agree to sell.

From the outside, the property looked acceptable — two sheds, a manageable yard, and a structure that didn’t scream disaster. The challenge was this: the seller’s family member lived inside, and we were unable to get full interior access before closing. She even asked that we not tell the occupant they were selling, which should have been an early warning sign.

Once we closed and got the occupant moved out, the reality hit. The interior was destroyed — walls damaged by dogs, trash everywhere, and enough structural and cosmetic issues that it was hard to believe the exterior had looked so calm. The roof was leaking, the septic system was questionable, and the overall cost to rehab was significantly higher than anticipated.

We spent roughly $3,000 just clearing debris and junk. After listing the property as-is, offers came back in the same range an investor would have paid before we bought it — around $90,000–$95,000 — compared to our purchase price of $110,000. In hopes of adding value, we spent another $8,000 repairing the roof. Still, buyers were reluctant, and final offers barely exceeded our original price.

In the end, we chose to sell at roughly $115,000 — enough to move on, but after holding costs, cleanup, repairs, and fees, we walked away with a net loss of around $8,000.

For homeowners, especially those with older or distressed properties, this story underscores something important: condition matters, and access matters even more. If a buyer cannot see inside before purchase, their price has to reflect that unknown. Otherwise, no amount of good intentions changes the risk they are taking on.

A Tax Auction Nightmare

Another deal I made was a tax auction purchase that looked perfectly fine from the outside — normal roofline, grass cut, and no obvious red flags. Because the property was occupied at the time of purchase, I couldn’t inspect the interior prior to closing.

Once the occupants were legally removed, we finally walked inside… and there were no floors, just dirt. Nothing. Imagine stepping into a house and finding bare earth where your living room should be. On top of that, the home was zoned commercial — a detail easily overlooked but one that drastically reduced the number of potential buyers and complicated exit strategies.

As of three years later, the property still sits unresolved.

This deal highlights another lesson: zoning, title, access, and condition can all sink a deal before you even start remediation. Homeowners in challenging situations should know that not all buyers are equal — cash buyers with experience in distressed properties are equipped to deal with issues that traditional house hunters are not.

What Homeowners Need to Understand

1. Sight Unseen = Risk

Any property sold without interior access involves risk. A buyer cannot accurately price repairs, insurance issues, plumbing, electrical, or hidden structural concerns without seeing it first.

2. Condition Affects Buyer Pool

In 2026, buyers are more selective. Homes that require major fixes — roof, septic, foundation, or interior damage — often have a smaller buyer pool and longer times on market, especially when mortgage rates remain elevated above historical lows.

3. Traditional Buyers vs. Cash Buyers

Conventional buyers, especially those financing through a mortgage, are often unable to purchase homes with significant unknowns. Cash buyers, on the other hand, can close fast and handle issues as part of their business model. That doesn’t mean they’ll pay retail prices — but it does mean they can buy houses others won’t.

4. Market Conditions Give You (and Them) More Leverage

With inventory rising and buyers being cautious, negotiations matter more than ever. Homes can take longer to sell, and buyers will request inspections, contingencies, and price reductions before committing.

Your Options as a Homeowner

If your house is facing any of the following situations, you still have options — and selling as-is to a reputable investor can be a smart move:

- Behind on mortgage payments

- Facing foreclosure

- Inherited property you don’t want

- Tenants who won’t leave

- Major repairs you can’t afford

- Health, divorce, or life changes

- Code enforcement or tax liens

You do not need to fix everything before selling. In many cases, trying to rehab or clean up a damaged property first actually reduces your leverage and increases your costs.

How I Can Help

My name is Chris Moore, and I help homeowners in Florida sell properties that traditional buyers often won’t touch.

I buy houses as-is.

No repairs.

No clean up.

No commissions.

If you want to know your options — whether selling for cash, exploring creative solutions, or just getting honest advice — reach out.

📞 Call or Text: (904) 478-9299

🌐 www.webuyanyhouseinflorida.com

Worst case, you get clarity.

Best case, you get a solution.

You deserve that.